In today's global financial landscape, cross-border money transfers have become increasingly common. Many individuals and businesses often find themselves puzzled by the proper way to complete bank information for international transactions. The use of SWIFT codes remains crucial for ensuring both the security and timely delivery of funds. This article examines the SWIFT/BIC code CIBLBDDHOBU of CITY BANK PLC. and its significance in international money transfers.

Understanding CITY BANK PLC. and Its SWIFT Code

Headquartered in Dhaka, Bangladesh at CITY BANK CENTER, 28 GULSHAN AVENUE, GULSHAN-1, DHAKA, DHAKA, 1212, BANGLADESH , CITY BANK PLC. serves as a key player in the local financial market. For those conducting international transfers, identifying the correct SWIFT code is essential. The SWIFT code (Society for Worldwide Interbank Financial Telecommunication code) functions as a unique identifier for banks and their specific branches, typically consisting of 8 to 11 characters.

The SWIFT code CIBLBDDHOBU for CITY BANK PLC. contains more than meets the eye. The first four characters CIBL represent the bank's code, followed by BD indicating Bangladesh as the country code. The next two characters DD specify Dhaka as the location, while the final three characters HOBU identify the particular branch office. Accuracy in using this code is paramount—any errors may result in delayed transfers or misdirected funds, potentially causing significant inconvenience.

Best Practices for International Transfers

Regular verification of SWIFT code information is strongly recommended, as financial institutions may update their codes due to mergers, branch reorganizations, or other operational changes. Before initiating any international payment, confirming the accuracy of the required bank codes should be treated as a mandatory step.

Given the complexity of international transfer processes, consulting with your bank beforehand to obtain detailed information about transfer fees, processing times, and exchange rates proves beneficial. Having this information readily available allows for better financial planning and budgeting.

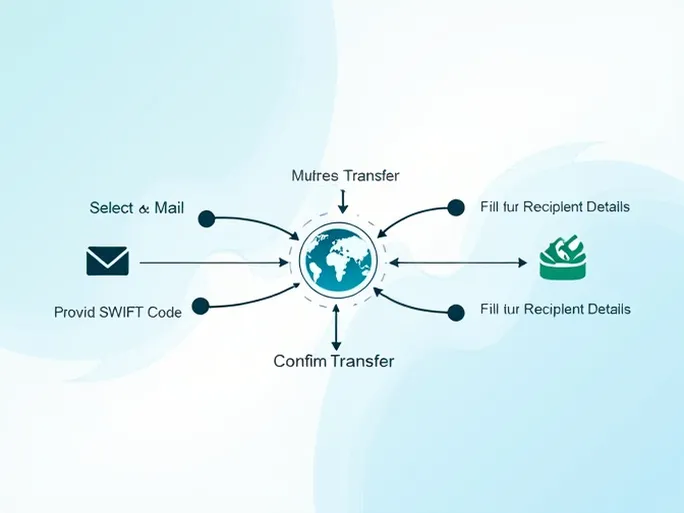

When conducting international remittances, providing comprehensive recipient details—including full name, bank account number, and bank address—in addition to the SWIFT code ensures the transaction's accuracy. The convenience of global payments comes with the responsibility of thorough information verification.

While international money transfers present certain challenges, understanding essential financial concepts like SWIFT codes empowers individuals and businesses to safeguard their transactions. Proper use of CIBLBDDHOBU facilitates not only secure but also efficient movement of funds to their intended destinations.