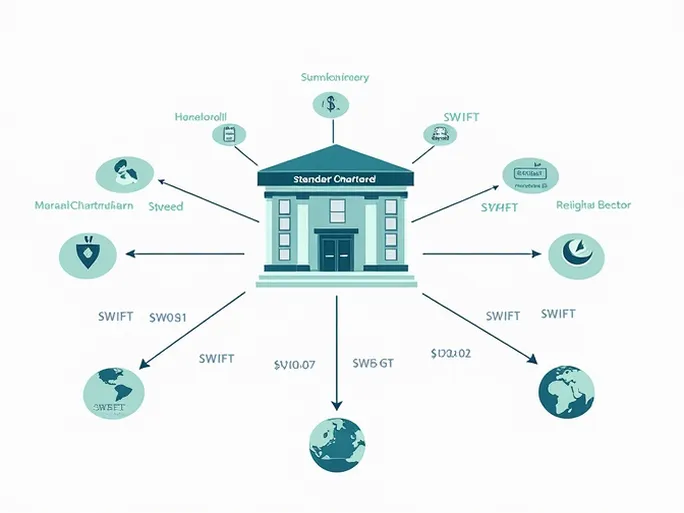

In today's globalized economy, international money transfers have become an essential part of both personal finance and business operations. The ability to move funds accurately and securely across borders relies heavily on professional financial institutions. In Tanzania, Standard Chartered Bank has emerged as a preferred choice for many, leveraging its extensive international experience and robust financial network.

Understanding SWIFT Codes in Global Transactions

SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes serve as unique identifiers assigned to financial institutions worldwide. These 8- or 11-character alphanumeric codes play a pivotal role in international transfers by precisely identifying specific banks and their branches, ensuring swift and secure fund movement.

Standard Chartered Bank Tanzania has established a strong reputation in the financial market through its global reach and professional services. The bank's SWIFT codes prove equally vital for both individual customers and corporate entities engaged in international commerce.

Standard Chartered's Position in Tanzania's Financial Sector

As one of the most internationally connected banks operating in Tanzania, Standard Chartered Bank holds significant prominence in the country's financial landscape. Since its establishment in the region, the institution has consistently delivered comprehensive financial services spanning personal banking, commercial banking, and investment banking solutions.

The bank's growing popularity for international transfers stems not only from its reliability and security measures but also from its streamlined transfer services that facilitate quick and efficient cross-border transactions. Whether sending money to family abroad or settling international trade payments, Standard Chartered ensures seamless fund delivery.

Practical Application of SWIFT Codes

International transfers demand meticulous attention to detail, with SWIFT codes serving as fundamental components. Unlike domestic transfers, cross-border transactions require precise information to prevent errors. Standard Chartered Bank Tanzania maintains distinct SWIFT codes for various branches.

Key SWIFT Code Information

The Dar es Salaam branch operates with the primary SWIFT code SCBLTZTXSSU , corresponding to its International House location. This specific identifier enhances transfer efficiency while simplifying customer transactions. The alternative code SCBLTZTXXXX serves as a backup for the same branch.

Customers retain flexibility in using either branch-specific codes or the bank's primary identifier for transfers. This adaptability proves particularly valuable in complex international transactions, helping clients navigate various scenarios successfully.

Essential Pre-Transfer Considerations

Several preparatory steps prove crucial before initiating international transfers:

- Verify complete recipient details including full name, account number, and correct SWIFT code

- Confirm the recipient bank's exact SWIFT code through official channels

- Prepare clear transfer instructions including amount, currency, and transaction purpose

Ensuring Transaction Security and Compliance

Standard Chartered Bank maintains rigorous compliance protocols for international transfers, implementing multi-layered security checks to safeguard client funds. Customers with security concerns may consult the bank's official resources or financial advisors for guidance.

For substantial transfers, consider implementing phased transactions to enhance oversight and traceability throughout the process.

Tracking and Monitoring Transfers

Modern digital banking platforms enable real-time transfer tracking, allowing customers to monitor transaction status, identify potential delays, and take appropriate action when necessary. This transparency proves particularly valuable for business clients managing international cash flows.

Staying Informed About Regulatory Changes

Evolving financial regulations may impact international transfer procedures. Customers should remain aware of policy changes and regularly review transfer fees, exchange rates, and service terms to optimize their cross-border transactions.

Conclusion

Proper understanding and use of SWIFT codes remains fundamental to successful international transfers. Standard Chartered Bank Tanzania provides reliable cross-border financial services supported by its global network. Maintaining accurate transaction details, adhering to compliance requirements, and utilizing available banking resources collectively contribute to efficient and secure fund transfers in today's interconnected financial landscape.