In today's globalized economy, cross-border money transfers have become essential for individuals and businesses alike. Whether it's students sending funds home or multinational corporations conducting business, the demand for secure and efficient international transactions has never been higher. Against this backdrop, understanding SWIFT codes has become crucial for anyone engaging in global financial transactions.

UBA: An African Financial Powerhouse

Founded in 1961, United Bank for Africa PLC (UBA) has grown to become one of Africa's largest and most extensive banking networks. Headquartered in Lagos, Nigeria, UBA operates in more than 20 African countries and maintains a presence in major global financial centers. The bank offers comprehensive financial services across personal, corporate, and investment banking sectors, leveraging its international expertise and professional teams to deliver secure and efficient solutions.

The Critical Role of SWIFT Codes

SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes, also known as BIC (Bank Identifier Codes), serve as unique identifiers in international financial transactions. These 8-11 character codes ensure accurate routing of funds between banks worldwide. For UBA, the SWIFT/BIC code is UNAFNGLA003, which contains specific information about the bank and its location.

Decoding UBA's SWIFT/BIC

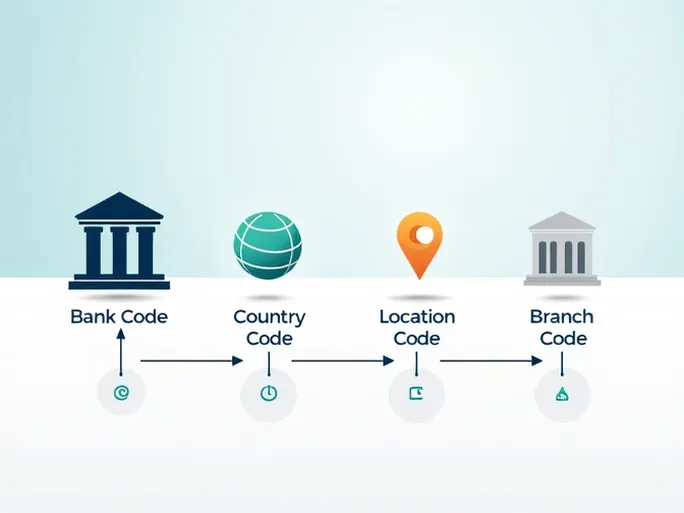

The UNAFNGLA003 code breaks down into four meaningful components:

- Bank Code (UNAF): Identifies United Bank for Africa as the financial institution

- Country Code (NG): Specifies Nigeria as the bank's home country

- Location Code (LA): Indicates the bank's primary operational hub in Lagos

- Branch Code (003): Provides additional specificity for transaction routing

Practical Applications of SWIFT Codes

Understanding when and how to use UBA's SWIFT code is essential for various financial activities:

- Personal remittances: Students and expatriates sending funds internationally

- Business transactions: Companies making payments to international suppliers or partners

- Foreign exchange operations: Facilitating currency conversions and transfers

- Investment activities: Managing cross-border investments and financing

Key Considerations for International Transfers

When initiating cross-border transactions through UBA or any financial institution, several factors warrant attention:

- Verify the accuracy of all SWIFT/BIC information before submission

- Understand the complete fee structure, including any intermediary bank charges

- Confirm all recipient details, including account numbers and beneficiary names

- Account for processing times which may vary by institution and destination

The Future of Global Transactions

While financial technology continues to evolve, introducing new payment platforms and methods, the SWIFT network remains a cornerstone of international banking. Institutions like UBA continue to enhance their global payment solutions, ensuring clients can conduct secure and efficient transactions worldwide. As economic integration deepens, the demand for reliable cross-border financial services will only intensify, with SWIFT codes maintaining their vital role in global finance.