In today's globalized financial landscape, SWIFT/BIC codes serve as essential components for international money transfers, ensuring funds reach their intended destinations accurately and efficiently. Many individuals experience concerns about potential delays or errors during cross-border transactions—understanding the structure of these codes can help mitigate such risks.

Decoding the SWIFT/BIC Structure

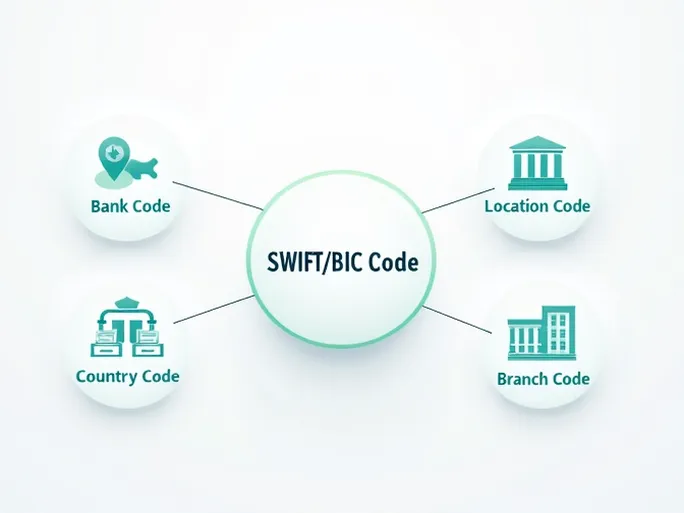

Typically comprising 8 to 11 alphanumeric characters, SWIFT/BIC codes uniquely identify specific banks and their branches worldwide. Consider the example of BANCO DE CREDITO DE BOLIVIA S.A., whose code BCPLBOLXCBB breaks down as follows:

- Bank Code (BCPL): The first four letters represent the financial institution's abbreviated name.

- Country Code (BO): The subsequent two letters indicate the bank's registered nation (BO for Bolivia).

- Location Code (LX): This segment identifies the institution's headquarters city.

- Branch Code (CBB): The final three characters specify particular branches, with "XXX" denoting a bank's head office.

Ensuring Transaction Accuracy

Precise SWIFT code verification remains critical for successful international transfers. Implement these verification measures to minimize processing issues:

- Bank Name Verification: Cross-check that the entered financial institution name matches the recipient bank's official designation.

- Branch Specificity: When using branch-specific codes, confirm alignment with the recipient's exact banking location.

- Country Validation: Verify the country code corresponds to the transfer destination, as multinational banks operate across jurisdictions.

These verification protocols facilitate seamless transactions while reducing financial risks associated with incorrect transfer details. As the fundamental credential for international banking operations, SWIFT/BIC codes function not merely as transactional identifiers but as vital safeguards for global financial security.