In the modern global financial system, SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes play a pivotal role. These standardized identifiers facilitate secure and efficient cross-border transactions, ensuring funds move seamlessly between banks. When conducting international transfers, the correct SWIFT code is essential to avoid errors and delays. This article examines the SWIFT code for EXIMBANK (Tanzania) Limited and outlines best practices for its use in international transactions.

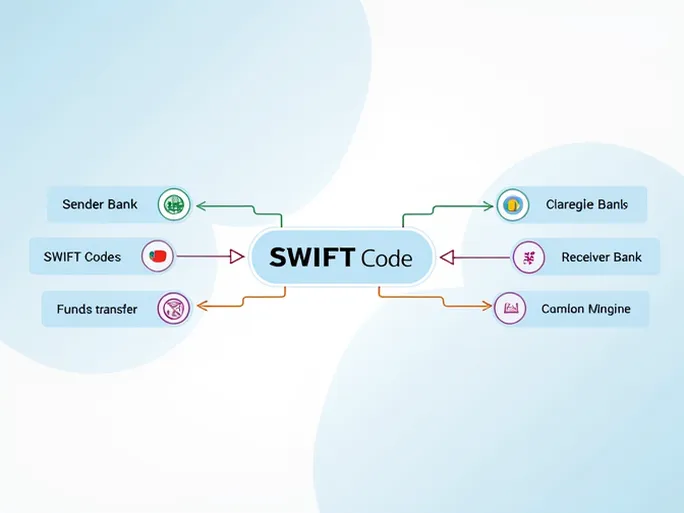

Understanding SWIFT Codes

A SWIFT code, also known as a Bank Identifier Code (BIC), is an 8- to 11-character unique identifier for financial institutions in international transactions. Its structure follows a specific pattern: the first four letters represent the bank code, the next two denote the country code, followed by two letters for the location, and an optional three-letter branch code. For example, EXIMBANK (Tanzania) Limited’s SWIFT code is EXTNTZTZTFD .

Breaking this down:

- EXT identifies EXIMBANK (Tanzania) Limited.

- NTZ is Tanzania’s country code.

- TZ specifies the bank’s location (Dar es Salaam).

- TFD designates a specific branch.

Understanding this structure is critical for clients initiating international transfers, particularly when the recipient bank is located in another country. For those sending funds to EXIMBANK (Tanzania) Limited in Dar es Salaam, using the correct SWIFT code EXTNTZTZTFD is imperative.

Key Details for International Transfers

EXIMBANK (Tanzania) Limited’s address is 9 Samora Avenue, Dar es Salaam, Tanzania . This information, along with the SWIFT code and the recipient’s account details, must be provided accurately to ensure a successful transfer. Errors in any of these fields may result in delays or failed transactions.

The process typically involves:

- Accessing your bank or remittance service provider’s platform.

- Entering the recipient’s bank details, including the SWIFT code EXTNTZTZTFD , address, and account information.

- Verifying all details before submission to minimize errors.

Fees may apply, depending on the bank or service provider’s policies.

Advantages of the SWIFT System

SWIFT’s global adoption by major banks and financial institutions ensures secure and efficient cross-border transactions. Its standardized framework allows for seamless fund transfers across nearly all countries, eliminating geographical limitations.

Important Considerations

While SWIFT is highly reliable, users should adhere to the following precautions:

- Verify the SWIFT code before initiating a transfer, as banks occasionally update their codes.

- Choose reputable financial institutions for remittances, prioritizing security and reliability over lower fees.

- Monitor exchange rates , as fluctuations may affect the final amount received.

- Comply with regulations in both the sender’s and recipient’s countries to avoid legal complications.

In developing nations like Tanzania, banking infrastructure may differ from that in more advanced economies. Awareness of these variations can help mitigate potential challenges.

The Rise of FinTech Alternatives

Traditional SWIFT-based transfers are increasingly supplemented by digital banking and FinTech solutions. Mobile apps and online platforms now offer faster, cost-effective alternatives for international remittances, reshaping the landscape of cross-border payments.

In summary, understanding and correctly using EXIMBANK (Tanzania) Limited’s SWIFT code EXTNTZTZTFD is essential for secure and efficient international transactions. By ensuring accuracy in bank details, selecting trusted service providers, and staying informed about regulatory and financial nuances, individuals and businesses can navigate global financial networks with confidence.