In the global financial system, SWIFT/BIC codes are essential tools for ensuring smooth international bank transfers. But do you truly understand what these codes mean and how they function? This article breaks down the structure and significance of the SWIFT/BIC code for Banco de la Nación Argentina, one of the country’s leading financial institutions.

What Is a SWIFT/BIC Code?

SWIFT (Society for Worldwide Interbank Financial Telecommunication) or BIC (Bank Identifier Code) is a unique alphanumeric code used to identify financial institutions worldwide. These codes, typically 8 to 11 characters long, play a critical role in cross-border transactions by directing funds to the correct bank and branch.

Decoding Banco de la Nación Argentina’s SWIFT/BIC

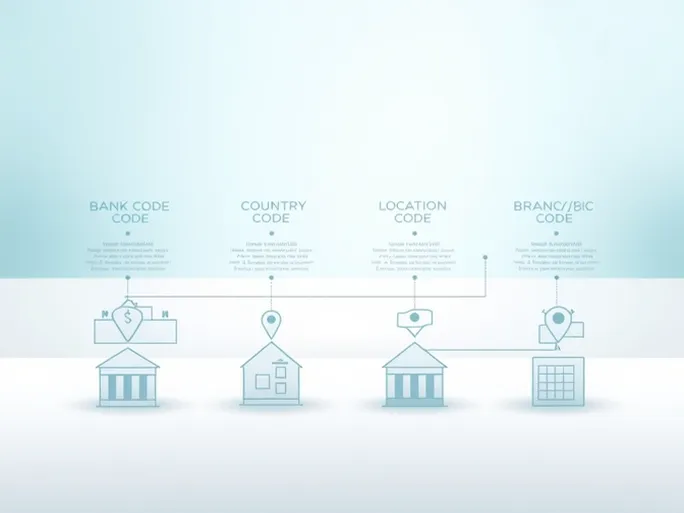

The SWIFT/BIC code for Banco de la Nación Argentina is structured as follows:

- Bank Code (NACN): The first four letters represent the bank’s abbreviated name—in this case, "NACN" for Banco de la Nación Argentina.

- Country Code (AR): The next two letters indicate the country where the bank is located—Argentina.

- Location Code (BA): The following two characters specify the bank’s headquarters or primary location.

- Branch Code (NEU or XXX): The last three characters identify a specific branch. A code ending in "XXX" typically refers to the bank’s main office.

Why Accuracy Matters in International Transfers

Using the correct SWIFT/BIC code is crucial to avoid delays or misdirected funds. Before initiating an international transfer, consider the following:

- Verify the Bank Name: Ensure the recipient’s bank name matches the SWIFT code provided.

- Confirm the Branch: If using a branch-specific code, double-check that it corresponds to the recipient’s account.

- Check the Country: The country code must align with the bank’s actual location to prevent transfer errors.

Precise SWIFT codes enhance the efficiency of global transactions and are indispensable in today’s interconnected economy. Whether for personal remittances or business dealings, ensuring the accuracy of payment details safeguards the security and reliability of financial transfers.