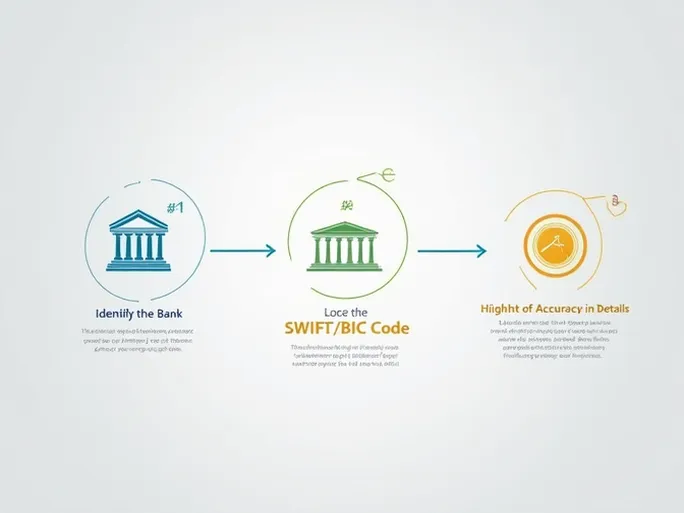

When sending money across borders, one pressing question dominates: How can you ensure your funds arrive safely and without delay? The global banking system relies on standardized identifiers to facilitate these transactions, with SWIFT/BIC codes serving as the universal language for financial institutions worldwide.

For those conducting business with Habib Bank Limited in Pakistan, the correct SWIFT/BIC code is essential. The bank's identifier— HABBPKKA033 —must be accurately included in all international wire transfers. Headquartered at Shop No.283/A, M Hussaini Chamber, R284/A Abdullah Haroon Road, Karachi, Sindh 74400, Pakistan, this financial institution processes cross-border transactions through the SWIFT network.

These alphanumeric codes perform a critical function in global finance. By uniquely identifying each banking entity, they prevent misrouted payments and reduce processing errors. Financial analysts estimate that incorrect SWIFT information causes approximately 15% of failed international transfers , often resulting in costly delays and administrative headaches.

While the SWIFT code forms the backbone of secure transactions, supplementary details prove equally important. Senders must verify the recipient's full account number, legal name as registered with the bank, and branch location. Even minor discrepancies—a misplaced digit or spelling variation—can trigger compliance reviews that freeze funds for days or weeks.

Habib Bank Limited's participation in the SWIFT network offers clients reliable international transfer capabilities. The bank's established presence in Pakistan's financial sector and adherence to global banking protocols provide assurance for both corporate and individual transactions. When initiating transfers, the HABBPKKA033 code serves as the essential routing mechanism that connects sending and receiving institutions.

Financial institutions recommend triple-verification of all transfer details before submission. This includes reconfirming the SWIFT code with the recipient, cross-checking account information, and validating personal identification details. Such diligence minimizes the risk of funds being held in limbo or returned to origin—a process that typically incurs substantial fees and consumes valuable time.