In today's globally integrated economy, cross-border payments have become indispensable for both individuals and businesses. When transferring funds to Egypt, understanding international payment protocols—particularly the use of SWIFT codes—is crucial for every sender. These unique identifiers serve as financial "passports," ensuring both efficient transfers and transaction security.

Banque du Caire: A Trusted Egyptian Financial Institution

Founded in 1952 and headquartered in Cairo, Banque du Caire (literally "Bank of Cairo") has established itself as a reputable Egyptian financial services provider. The bank offers comprehensive solutions including retail banking, corporate services, investment banking, and asset management. With digital transformation accelerating globally, Banque du Caire has expanded its online and mobile banking capabilities to serve clients more efficiently.

As one of Egypt's leading banks, Banque du Caire plays a significant role in international finance, facilitating cross-border transactions through its SWIFT-enabled network.

Understanding SWIFT Codes for International Transfers

The SWIFT code (Society for Worldwide Interbank Financial Telecommunication) is a standardized identifier for financial institutions worldwide. These 8-11 character codes follow a specific structure:

- Bank code (4 characters): Identifies the financial institution

- Country code (2 characters): ISO country designation (EG for Egypt)

- Location code (2 characters): Specifies the bank's address

- Branch code (3 optional characters): Identifies specific branches

Banque du Caire's primary SWIFT code— BCAIEGCX030 —breaks down as follows:

- BCAI: Bank identifier

- EG: Egypt country code

- CX: Location designation

- 030: Branch specification

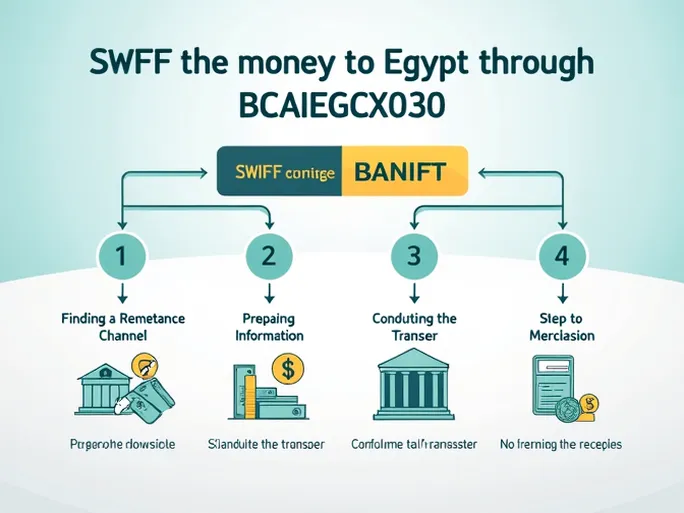

Step-by-Step Transfer Process

To successfully transfer funds to Banque du Caire:

1. Select Your Transfer Method

Options include traditional bank transfers (in-person or online), mobile banking apps, or third-party services like Western Union. Digital platforms typically offer faster processing times.

2. Gather Required Information

Essential details include:

- Recipient's full legal name

- Account number at Banque du Caire

- SWIFT code: BCAIEGCX030

- Bank address: 19 Adly Street, Cairo 11511, Egypt

- Transfer amount and currency

3. Initiate the Transfer

Enter the collected information through your chosen platform. Most transactions process within 24 hours, though processing times may vary depending on intermediary banks and currency exchange requirements.

4. Confirm Transaction Details

Retain all confirmation receipts (emails, SMS notifications, or reference numbers) for tracking purposes and potential dispute resolution.

Fees and Processing Times

International transfers typically incur several charges:

- Fixed sending fees (varies by institution)

- Currency exchange margins

- Potential receiving bank fees

For example, transferring £10,000 to Banque du Caire might incur total fees between £20-£40, depending on the service provider. The recipient would receive the equivalent in Egyptian pounds based on current exchange rates.

While standard transfers usually complete within one business day, holidays or technical issues may cause delays. For time-sensitive transactions, consider initiating transfers earlier than necessary.

Security Considerations

To ensure safe international money transfers:

- Double-check all SWIFT codes before submission

- Only conduct transactions on secure, private networks

- Safeguard sensitive banking information

- Regularly monitor account activity for unauthorized transactions

The Future of Cross-Border Payments

Financial technology continues revolutionizing international money transfers. Emerging solutions—including blockchain-based platforms and digital wallets—promise faster, more cost-effective alternatives to traditional banking channels. Many institutions now offer real-time tracking and flexible transfer limits to meet evolving customer needs.

Conclusion

Transferring funds to Banque du Caire requires attention to detail but follows standardized international banking procedures. By verifying SWIFT codes and understanding the transfer process, individuals and businesses can execute secure, efficient transactions to Egypt. As financial services evolve, staying informed about new payment technologies ensures optimal transfer experiences.