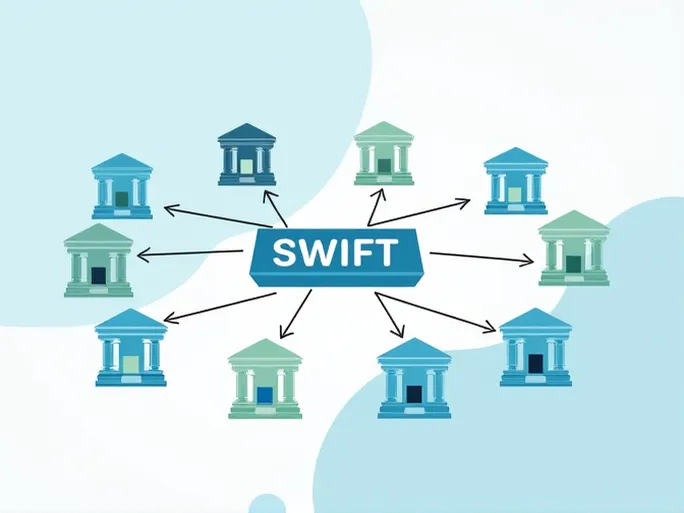

In today's globalized economy, international financial transactions have become a vital component of economic exchanges between nations. Within this framework, the security and accuracy of cross-border fund transfers are paramount. To ensure the precise movement of funds across borders, the SWIFT system was established, providing essential infrastructure for the effective operation of global financial markets.

SWIFT stands for "Society for Worldwide Interbank Financial Telecommunication," a standardized communication protocol that enables banks to conduct financial transactions securely and efficiently. At the heart of this system, SWIFT codes serve as unique identifiers—the "passports" of international banking transactions.

Decoding the SWIFT System: A Case Study of Egypt's National Bank

Consider the National Bank of Egypt as an example. The institution's SWIFT/BIC code, NBEGEGCX002, serves not only as its unique identifier within the global financial system but also as a critical element for ensuring secure international transfers. The structure of this code contains multiple layers of information designed to precisely locate the bank and its specific branch within the complex international financial network.

Anatomy of a SWIFT Code

A closer examination of NBEGEGCX002 reveals the sophisticated design of SWIFT codes, which typically consist of 8 to 11 characters, each segment conveying specific banking and location information:

- NBEG : Represents the bank's abbreviated name (National Bank of Egypt), ensuring uniqueness in the global banking system.

- EG : The country code for Egypt, enabling quick identification of the transaction's destination country.

- CX002 : Identifies the specific branch, with "C" indicating the bank's business type and "X002" pinpointing the exact branch location.

The Importance of Bank Address Verification

While SWIFT codes are essential, physical bank addresses remain equally crucial for international transfers. The National Bank of Egypt's primary address at 24 Sherif Street, Cairo, with postal code 11511, must be verified with equal diligence. As banks expand globally with multiple branches, accurate address information becomes critical to prevent transfer delays or errors.

Before initiating any international transfer, thorough verification of both the recipient's bank details and SWIFT code is strongly advised. In the world of cross-border transactions, precision equals security—even minor errors in SWIFT codes or addresses can result in frozen funds or misdirected transfers.

SWIFT's Global Impact

The SWIFT network represents a global financial messaging system that has revolutionized international banking. According to data from the International Monetary Fund, SWIFT currently connects over 11,000 financial institutions worldwide, processing millions of transactions daily with values reaching trillions of dollars.

This extensive network not only enhances transfer efficiency but also implements robust security measures to protect transaction integrity. Each transfer undergoes rigorous data validation and encryption, ensuring financial information remains secure even in open internet environments.

Best Practices for SWIFT Transactions

When conducting international transfers, using the correct SWIFT code—such as NBEGEGCX002—is absolutely critical. Errors in code entry may result in funds being sent to incorrect institutions or becoming unrecoverable. Additionally, verifying whether the recipient's bank supports SWIFT transfers is equally important, as some smaller or regional financial institutions might not participate in the system.

While the SWIFT system provides remarkable convenience for international banking, understanding branch-specific information remains essential. Ensuring perfect alignment between the SWIFT code and the recipient's account details guarantees funds reach their intended destination securely and promptly.

Navigating Challenges in Global Transactions

As global economic activity expands, international money transfers have become increasingly common. However, this growth brings complex challenges ranging from exchange rate fluctuations and transaction fees to regulatory compliance. While SWIFT codes provide fundamental support for these transactions, all parties must maintain clear communication and coordination to ensure smooth fund movement.

Emerging financial technologies (FinTech) offer potential solutions to streamline cross-border payments and reduce costs. Nevertheless, the SWIFT network remains an indispensable foundation for achieving true transparency and security in international finance.

The Path Forward

For individuals and businesses operating in international markets, understanding SWIFT codes and their underlying systems is fundamental. By mastering codes like NBEGEGCX002 and meticulously verifying bank addresses and branch information, users can navigate cross-border transactions with confidence. Attention to detail ensures funds move efficiently through global economic channels, ultimately supporting financial objectives.

As international finance continues to evolve, the importance of SWIFT codes and related knowledge will only grow. For future financing and investment activities, maintaining awareness of these critical details remains essential for success in the global marketplace.