In today's volatile global economy, fluctuations between the US dollar and Indonesian rupiah present crucial information for every investor. Understanding these currency movements can mean the difference between profitable decisions and missed opportunities in international markets.

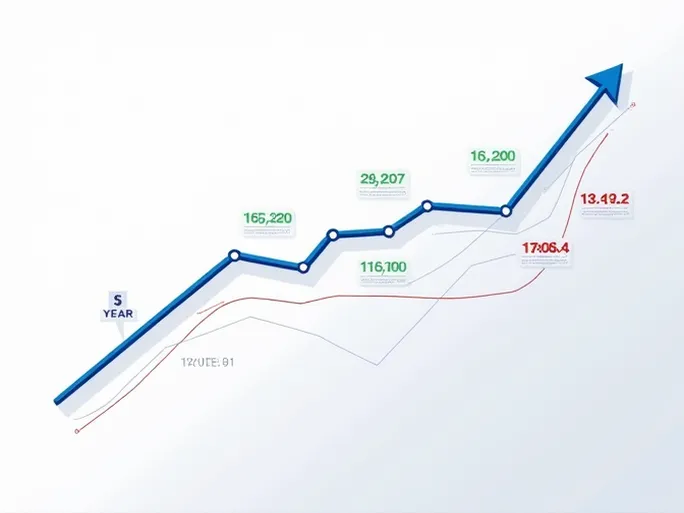

According to historical exchange rate data, as of August 8, 2025 , 1 USD traded at 16,243.8 IDR . The past year has seen significant volatility, with the exchange rate reaching a low of 15,120 IDR and peaking at 17,066.1 IDR . These substantial swings reflect both market dynamism and potential investment prospects for those monitoring currency trends.

When conducting cross-border transactions or investments, understanding the mid-market rate becomes essential. This benchmark directly impacts currency exchange costs. It's important to note that published rates represent the midpoint between global buy and sell prices, which may differ from actual transaction rates offered by financial institutions.

For both seasoned international investors and those new to foreign exchange markets, continuous monitoring of USD/IDR fluctuations remains critical. Market timing can significantly influence investment outcomes, particularly when dealing with currencies demonstrating such notable volatility.

In these rapidly changing financial markets, information translates directly into opportunity. Each percentage point movement in exchange rates could potentially impact investment portfolios, making currency awareness an indispensable component of global investment strategy.