In the construction and decoration industries, rough or unworked granite is highly valued for its natural texture and durability. For international trade, understanding the Harmonized System (HS) code and associated tariff policies is crucial. This article provides a detailed analysis of HS code 2516110000, covering tariff rates, declaration requirements, and regulatory conditions.

Basic Information

HS Code

: 2516110000

Commodity Name

: Rough or unworked granite

Description

: Granite that has not undergone fine processing or has only been roughly worked, suitable for construction and decoration purposes.

Code Status

: Active

Last Updated

: April 6, 2025

Tariff Information

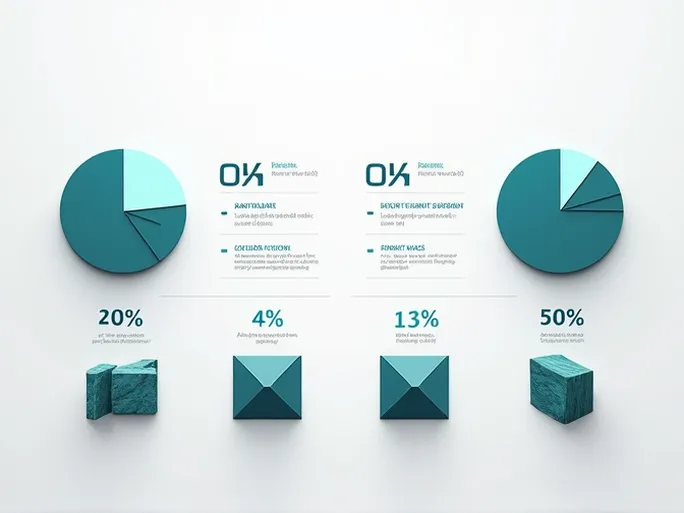

The import and export tariff rates for this commodity are as follows:

| Category | Rate |

|---|---|

| Unit of Measurement | Kilograms (kg) |

| Export Tariff Rate | 0% |

| Export VAT Refund Rate | 0% |

| Value-Added Tax (VAT) | 13% |

| Most-Favored-Nation (MFN) Tariff Rate | 4% |

| Provisional Import Tariff Rate | 0% |

| General Import Tariff Rate | 50% |

| Consumption Tax | None |

Declaration Requirements

For import and export declarations, the following information must be provided:

- Brand Type : As applicable

- Export Preference Status

- Processing Method : Natural state, rough work, sawing, cutting, etc.

- Appearance : Color and shape

- Volume or Area : Cubic meters (m³) or square meters (m²)

- Variety Name : In both Chinese and English

- Specifications : Length, width, and height

- Mine Name

- GTIN

- CAS Number

- Other Relevant Details

Regulatory Conditions

According to Chinese customs regulations, imports of this commodity require an Entry Goods Clearance Certificate to ensure compliance. Additionally, the product falls under import inspection categories, requiring traders to prepare for relevant inspections.

Agreement Tariffs

When trading with certain countries, preferential agreement tariffs may apply:

- ASEAN : 0%

- Chile : 0%

- New Zealand : 0%

- Australia : 0%

- South Korea : 0%

- Other countries may also qualify for 0% rates under specific trade agreements.

RCEP Tariffs

Under the Regional Comprehensive Economic Partnership (RCEP), the following countries maintain a 0% tariff rate for this commodity:

- Australia

- Brunei

- Cambodia

- South Korea

- Other RCEP member states

HS Classification

Rough or unworked granite is classified under the following categories:

- Section V : Mineral Products

- Chapter 2516 : Granite, porphyry, basalt, sandstone, and other monumental or building stone

- Subheading 251611 : Rough or unworked granite

This classification affects market value and directly influences tariff rates and declaration procedures.

CIQ Code

The customs inspection code for this commodity is 2516110000999 , which facilitates smooth trade transactions.

In summary, the market value of granite is closely tied to trade policies and tariff structures. A thorough understanding of these regulations enables businesses to optimize their import and export strategies effectively.