In international trade, accurately identifying a product's Harmonized System (HS) code and associated tariff rates is critical, particularly for specialized commodities like frozen pine nuts. This article provides an in-depth analysis of HS code 0811909021 , detailing applicable tax rates, regulatory requirements, and market insights to help exporters navigate cross-border transactions efficiently.

Key Tariff and Regulatory Information

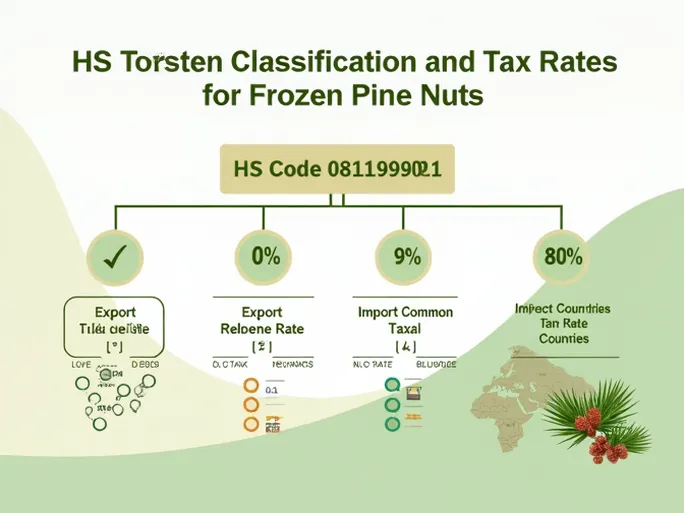

The HS code 0811909021 specifically applies to "frozen pine nuts, whether shelled or unshelled" . Below are the latest tax and trade parameters:

- Measurement Unit: Kilograms (kg)

- Export Tax Rate: 0%

- Export Tax Rebate: 9%

- VAT Rate: 9%

- Most-Favored Nation (MFN) Import Duty: 30%

- General Import Duty: 80%

These fiscal variables—especially MFN rates, VAT, and export rebates—significantly influence trade feasibility and profit margins for exporters.

Compliance and Inspection Requirements

Frozen pine nuts are subject to multiple regulatory controls to ensure quality and safety:

- Customs Clearance Documents: Entry/Exit Goods Declarations (Type A/B)

- Endangered Species Certification: Required if applicable (Type E)

-

Inspection Categories:

- R: Import Food Hygiene Supervision

- S: Export Food Hygiene Supervision

- P/Q: Cross-border Animal/Plant Quarantine

Preferential Trade Agreement Rates

Tariffs vary under bilateral agreements. Notable examples include:

- ASEAN, New Zealand, Chile, Australia: 0%

- South Korea: 13.5%

- Peru/Ecuador: 26–26.5%

- RCEP Members (e.g., Australia, Singapore, Malaysia): 24%

The Regional Comprehensive Economic Partnership (RCEP) offers competitive rates for Asian markets, potentially enhancing export opportunities.

Product Classification Details

Frozen pine nuts fall under Chapter 08 (Edible Fruits and Nuts), specifically:

- 081190: Frozen fruits and nuts, whether or not cooked or sweetened

- 08119090: Other unspecified frozen fruits/nuts

- CIQ Code: 0811909021999 (for precise customs declaration)

Mastering these classifications ensures smooth customs clearance and minimizes logistical delays.

Strategic Considerations for Exporters

Given the complexity of tariffs and regulations, exporters should:

- Verify destination-specific rates under applicable trade agreements

- Prepare all compliance documentation in advance

- Monitor updates to MFN or preferential tariffs

Accurate HS code application and tax planning are indispensable for optimizing international trade operations involving frozen pine nuts.