In our globalized economy, international trade has become an indispensable engine for national economies. With the continuous growth in worldwide fruit consumption, fruit exports have emerged as a focal point for many businesses and traders. From fresh tropical fruits to dried nuts, various fruit categories offer vast potential in international markets. However, to successfully export fruits, understanding the relevant HS codes and export regulations is crucial. This article will explore the fruit categories under HS Code Chapter 08 and how to leverage this information to enhance your export business and gain a competitive edge.

Understanding HS Codes

Before venturing into fruit exports, it's essential to understand HS codes. The Harmonized System (HS) code, or "International Product Classification Code," serves as a vital tool for product classification and identification in global trade. These numerical codes provide a standardized system for thousands of products, facilitating smoother communication in trade processes.

Chapter 08 of the HS code specifically covers various fruits and nuts, making it the core section for fruit exports. Familiarity with these codes not only improves efficiency in customs declarations but also ensures your export business complies with international standards.

Fruit Categories Under HS Code Chapter 08

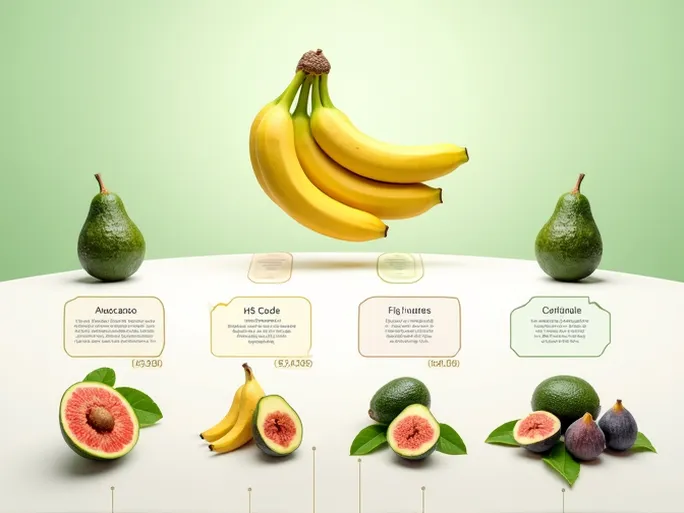

Chapter 08 encompasses numerous fresh and dried fruits, many of which hold significant importance in international markets. Below are key fruit categories with their corresponding HS codes and export tax rebate information:

1. Other Nuts, Fresh or Dried (HS Code: 0802.99.90)

This category includes various specialty nuts, typically measured by weight (kilograms), with a 9% tax rebate. Demand for these nuts has been steadily increasing, particularly in the health food sector.

2. Bananas and Plantains, Fresh or Dried (HS Code: 0803.00.00)

As one of the world's most popular fruits, bananas benefit from efficient production and transportation systems, enjoying a 9% export tax rebate.

3. Plantains, Fresh or Dried (HS Code: 0803.10.00)

Similar to bananas, plantains are measured by weight (kilograms) and benefit from a 9% tax rebate, enhancing their export competitiveness.

4. Fresh Dates (HS Code: 0804.10.00)

Dates are prized for their unique nutritional value and rich flavor profile. Measured by weight (kilograms), they qualify for a 9% tax rebate upon export.

5. Fresh Figs (HS Code: 0804.20.00)

This distinctive fruit offers excellent taste and numerous health benefits. Measured by weight (kilograms), it also enjoys a 9% export tax rebate.

6. Avocados, Fresh or Dried (HS Code: 0804.40.00)

With the growing popularity of healthy eating, international demand for avocados continues to rise. Measured by weight (kilograms), they qualify for a 9% export tax rebate.

Chapter 08 also includes other popular fruits like fresh guavas, mangoes, and oranges. These fruits enjoy popularity not only in domestic markets but also among international consumers. Mastering this information allows for more confident decision-making when selecting fruits for export.

Leveraging HS Codes for Export Success

Understanding HS codes and their application directly impacts your fruit export business. Here are practical recommendations to enhance your export operations:

1. Accurate Declaration and Customs Clearance

Ensure your product declarations precisely match the relevant HS codes. Accurate declarations reduce clearance times and minimize errors that could lead to penalties or restrictions.

2. Market Research

Conduct thorough market research before selecting fruits for export. Understanding different countries' fruit preferences, tax policies, and market trends provides valuable data for strategic planning.

3. Competitive Pricing Strategy

Utilize tax rebate information from HS codes to calculate more competitive pricing. Appropriate pricing attracts customers while improving profit margins.

4. Optimized Logistics and Supply Chain

Understand the optimal transportation methods and shelf life for each fruit type to ensure efficient inventory management and logistics coordination. This approach significantly reduces delivery times and enhances customer satisfaction.

5. Compliance with International Trade Regulations

HS codes form a critical component of international trade regulations. Stay informed about evolving import restrictions on specific fruits to adjust your strategies accordingly.

6. Strengthening Partner Communication

Maintain clear communication with logistics providers, importers, and distributors to ensure all supply chain participants understand the importance and proper use of HS codes.

The Fruit Export Process: A Step-by-Step Overview

With HS code knowledge in hand, understanding the complete fruit export process becomes crucial. This includes production, inspection, packaging, transportation, customs clearance, and more.

1. Production and Quality Control

Quality control begins at the production stage. Select premium-quality fruits that meet international standards, with inspections conducted before and after harvest.

2. Packaging and Labeling

Proper packaging protects fruit quality during transit. Ensure all labels and documentation comply with destination country requirements to prevent export delays.

3. Transportation and Storage

Select appropriate transportation methods and temperature controls, especially for perishable fruits like mangoes and figs. Professional cold chain logistics help minimize spoilage.

4. Customs Clearance

Prepare all required documentation meticulously, paying special attention to HS code accuracy. Streamlined customs processes save significant time and costs.

5. Customer Experience and After-Sales Service

Monitor customer feedback post-export to continuously improve service and product quality. Positive experiences generate repeat business and referrals.

Conclusion

Fruit exports present abundant opportunities in today's global marketplace. By mastering HS Code Chapter 08, businesses can navigate complex international markets effectively. Each fruit variety carries unique cultural and flavor profiles, positioning exporters as more than just commodity traders but as cultural ambassadors.

Understanding and utilizing HS Code Chapter 08 unlocks endless possibilities for fruit exporters. By implementing these strategies and techniques, businesses can distinguish themselves in competitive markets. Continuous exploration of fruit categories and trade policies reveals new commercial opportunities, driving business growth forward. In this era of international trade filled with both challenges and prospects, let's collectively embrace the promising future of fruit exports!