In today's bustling global trade market, tungsten products have garnered significant attention due to their exceptional physical properties and wide-ranging applications, particularly in manufacturing and high-tech industries. As a crucial metal material, tungsten finds uses across electrical, aerospace, electronics, and mechanical sectors, with its high melting point, density, and excellent conductivity making it indispensable for many high-end products. This article provides an in-depth analysis of tungsten products, particularly those classified under HS code 8101991000, helping businesses navigate export challenges and maximize the potential of tungsten product exports.

Understanding HS Code 8101991000

HS code 8101991000 specifically refers to wrought tungsten products, including bars, rods, plates, sheets, strips, and foils in various forms. Importantly, it excludes products formed through simple sintering. This classification facilitates international trade by reducing trade barriers. Notably, since its latest update on March 20, 2025, HS code 8101991000 has maintained broad applicability and effectiveness in international trade, helping businesses quickly identify and categorize tungsten products for seamless trade activities.

Tax Policies for Tungsten Products

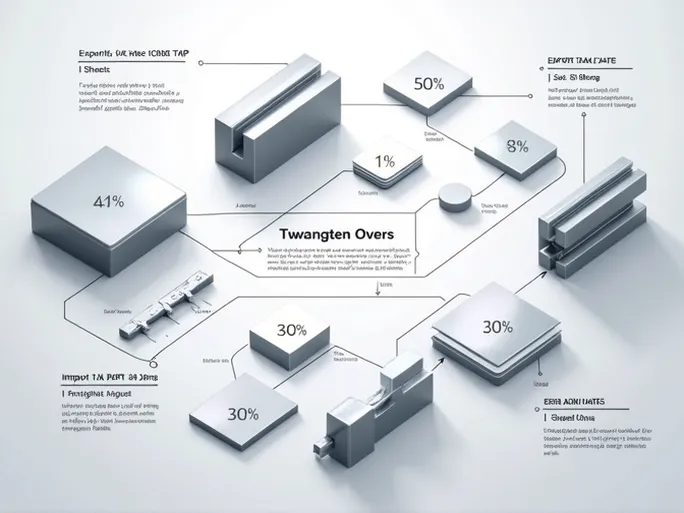

Understanding tax policies is crucial for any exporter engaged in international business. For tungsten products under 8101991000, both the export tax rate and export rebate rate stand at 0%. This favorable policy significantly reduces financial burdens and maximizes profit potential for exporters. For domestic sales, the value-added tax (VAT) is set at 13%, providing a clear financial framework for business operations.

However, importers face a different scenario, with a standard import tax rate of 30% for this product category. This substantial tariff increases import costs and significantly impacts corporate import decisions. Businesses must carefully weigh the differences between export and import tax policies to optimize cost control and enhance market competitiveness. The Most-Favored-Nation (MFN) tax rate of 5% presents an important opportunity for eligible importing countries to reduce costs.

Key Declaration Elements

Proper declaration is essential for successful exports, helping to minimize risks and delays in the export process. Businesses must provide several critical pieces of information when declaring these products, including:

- Product form (bars, rods, plates, etc.)

- Material composition (tungsten and its alloys)

- Manufacturing method (wrought)

- Intended use

- Product weight

- Whether hollow cylindrical in shape

- Brand and model information

These details not only facilitate smoother customs clearance but also ensure product traceability and tax compliance. A compliant declaration process enhances a company's international reputation and competitive edge.

Regulatory and Inspection Requirements

Tungsten products classified under 8101991000 currently face no special regulatory conditions or inspection requirements, offering exporters greater autonomy and flexibility in international trade. However, businesses should remain vigilant about potential country-specific requirements to avoid unexpected compliance issues.

Under the Regional Comprehensive Economic Partnership (RCEP) agreement, exports to multiple countries including Australia, Brunei, Cambodia, and Laos enjoy a 0% tax rate. This policy creates significant opportunities for businesses looking to expand their export markets in competitive environments.

Developing a Successful Export Strategy

In the ever-changing landscape of international trade, developing an effective export strategy is crucial for success in the tungsten products market. Businesses should consider the following approaches:

Market Research and Trend Analysis

Understanding international market demands and trends forms the foundation of strategic decision-making. Regular market research helps businesses adapt production and export plans to evolving market needs.

Quality and Brand Development

Investing in product quality and brand reputation enhances competitiveness in international markets. High-quality products and strong brand recognition increase customer confidence and purchasing decisions.

Customer Service and Digital Management

Developing robust after-sales service systems and digital management platforms improves customer satisfaction and retention, creating long-term business relationships.

Industry Engagement

Active participation in international trade shows and industry events boosts visibility while creating opportunities to connect with potential clients and partners.

In conclusion, for tungsten products classified under HS code 8101991000, thorough understanding of tax policies, declaration requirements, and market dynamics provides businesses with a competitive advantage. By continuously improving product quality, optimizing export strategies, and strengthening brand presence, companies can create greater value in international markets and achieve sustainable growth.