In the insurance industry, the deductible is a fundamental concept that significantly impacts policyholders' financial responsibilities. Many consumers face confusion about how deductibles affect their actual claims when purchasing insurance coverage. A well-structured deductible arrangement can help manage insurance costs while providing flexibility when accidents occur.

The deductible refers to the amount of loss that the policyholder must pay out of pocket before the insurance company begins to cover the remaining costs. For instance, if your policy has a $500 deductible and you file a claim for $10,000 in damages, the insurance company would pay $9,500 after you've paid the initial $500. This mechanism serves as a core element of insurance policies, helping insurers share risk while reducing overall policy costs.

Example: A homeowner with a $1,000 deductible experiences $5,000 in storm damage. They pay the first $1,000, and their insurer covers the remaining $4,000. This structure encourages policyholders to share in risk management while preventing small, frequent claims.

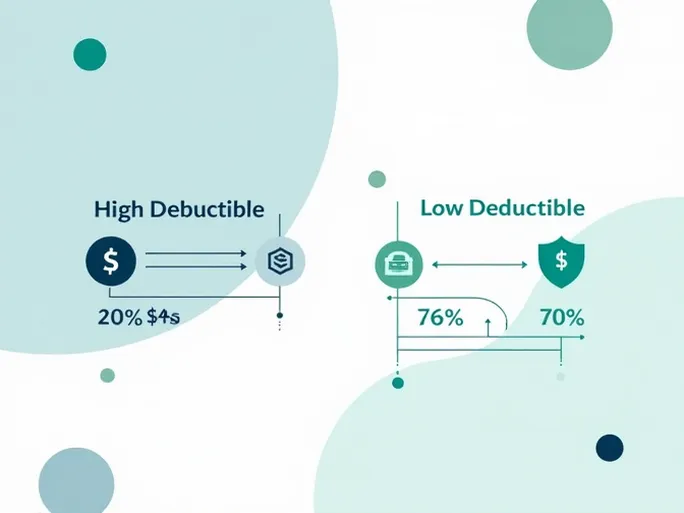

Selecting an appropriate deductible level is crucial for policyholders. Generally, higher deductibles result in lower premium payments, while lower deductibles lead to higher premiums. When choosing a deductible amount, individuals should carefully evaluate their financial situation, risk tolerance, and specific policy details to make the most advantageous decision.

In practice, policyholders can adjust their deductibles based on personal budgets and risk preferences. Those who prefer greater financial security against unexpected expenses might opt for lower deductibles with corresponding higher premiums. Conversely, individuals comfortable assuming more financial responsibility could choose higher deductibles to reduce their regular insurance costs. This approach makes deductibles both a risk management tool and a cost control mechanism.

It's important to recognize that deductible selection represents a form of financial planning. In most cases, the deductible constitutes the policyholder's initial financial responsibility when a loss occurs, with insurance coverage protecting against amounts beyond this threshold. Proper advance planning of deductible levels can help prevent financial strain following an incident.

Ultimately, deductibles play a vital role in insurance contracts. By carefully analyzing deductible structures and their potential financial implications during the purchasing process, consumers can secure better protection for future claims. When making insurance decisions, consulting with insurance professionals is recommended to ensure the selection of policy terms that best match individual needs.