Recent sanctions targeting Russian and Iranian oil exports are dramatically altering the landscape of the global tanker market, with ripple effects across energy supply chains and shipping economics.

Expanding Sanctions Regime

The U.S. Treasury Department on July 30 imposed sanctions on more than 100 individuals, companies and vessels involved in Iran's petroleum and petrochemical exports. This move follows the European Union's 18th sanctions package on July 18, which slashed the price cap on Russian crude from $60 to $47.60 per barrel, effective September 3.

While the U.S. participated in the original G7 price cap agreement, it has not formally endorsed the EU's revised ceiling. The European bloc has also banned refined petroleum products processed from Russian crude in third countries, with exemptions for Canada, Norway, the U.S., U.K. and Switzerland.

These measures demonstrate Western determination to curb Moscow and Tehran's oil revenues, though strategic coordination remains limited. The EU primarily seeks to reduce Russia's energy income, while Washington pursues broader geopolitical objectives through economic pressure, including using trade leverage to revive diplomatic engagement with Iran.

Parallel Markets and Tanker Adaptations

Historically, sanctions against Russia, Iran and Venezuela have spawned parallel oil markets. Despite stricter enforcement and expanded lists of sanctioned vessels, Russian crude continues reaching designated buyers, while Iranian oil has consistently flowed to Asian markets since U.S. sanctions resumed in 2019.

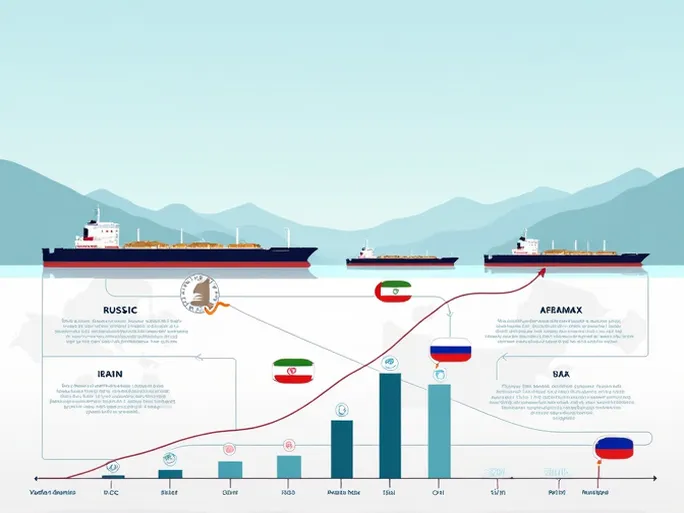

The critical question is how new restrictions will reshape tanker market dynamics. Though Washington hasn't penalized Russian oil purchases directly, substantial fines could prompt India — Moscow's largest crude buyer — to seek alternative suppliers. Most Indian imports of Russian crude currently utilize Suezmax and Aframax tankers.

Any significant reduction in Russian crude imports by India would dramatically increase its demand for Middle Eastern oil, boosting VLCC (Very Large Crude Carrier) requirements while decreasing mid-sized tanker usage, which typically carry smaller loads from the Arabian Gulf.

Shadow Fleets and Market Consequences

Iran has maintained exports through its "dark fleet" of obscure tankers since 2019. However, fresh U.S. sanctions targeting Iran-related shipping networks may temporarily disrupt these flows. Given current market oversupply, other Middle Eastern producers could readily compensate for any Iranian export declines, minimizing global oil price impacts.

The EU's drastic Russian price cap reduction to $47.60 will severely limit Moscow's ability to use mainstream international tankers. With Urals crude unlikely to trade below this threshold, Russia must increasingly rely on its "shadow fleet" — aging vessels often purchased by obscure entities specifically for sanctioned trade.

As Western sanctions target more vessels, sanctioned nations are acquiring additional non-sanctioned ships, squeezing available tonnage for legitimate trade and supporting freight rates. The 2022 tanker market already saw frenzied activity for vessels over 15 years old, with unknown buyers snapping up ships for Russian oil transport.

This demand surge has propped up secondhand tanker values while dramatically reducing scrapping activity from 2022-2024, keeping older vessels operational. Renewed sanctions are now reigniting interest in aging tonnage, providing support for softening asset prices in the secondhand market.

Long-Term Implications

The evolving sanctions regime is accelerating the bifurcation of global tanker fleets into sanctioned and non-sanctioned segments. While creating short-term market dislocations, these measures may ultimately strengthen Russia and Iran's parallel shipping networks, making enforcement increasingly difficult over time.

For legitimate operators, reduced vessel availability could sustain higher freight rates, particularly for smaller tanker classes favored in sanctioned trades. Meanwhile, environmental concerns take a backseat as aging, less efficient vessels remain in service to circumvent restrictions.

The coming months will reveal whether tightened sanctions achieve their intended economic pressure or simply reinforce the resilience of parallel energy markets that have flourished under previous restrictions.