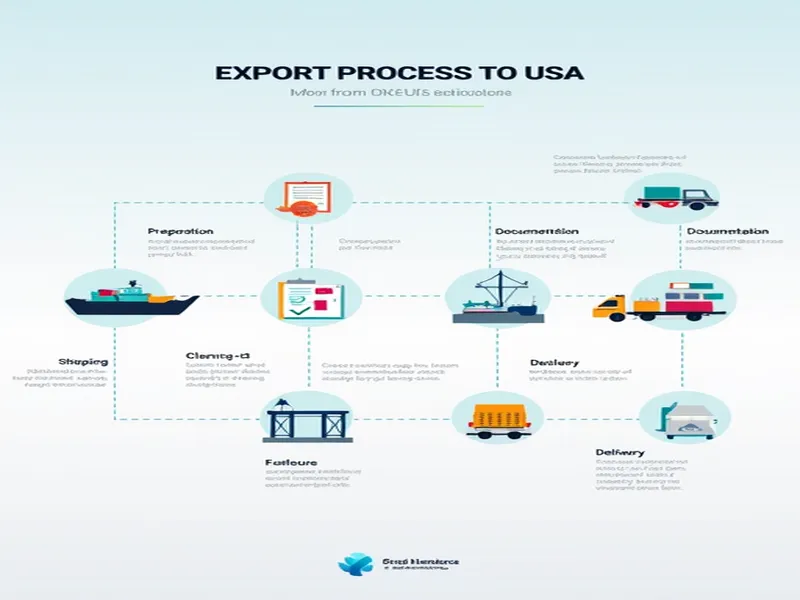

To successfully export goods to the United States and ensure efficient customs clearance, we will examine critical aspects of the export process. The following Q&A format provides comprehensive insights into the details and requirements of this process.

A: In international trade, service standards directly impact the smoothness of cargo transportation. If goods aren't promptly cleared upon arrival at the destination port, they may be transferred to G.O. warehouses, incurring additional storage fees. Therefore, timely and high-quality services are essential to minimize port delays, reduce costs, and ensure customer satisfaction.

A: Selecting a compliant freight forwarder is critical. You can check the forwarder's registration information through the Federal Maritime Commission (FMC) website to confirm they possess an NVOCC code. Without proper registration and qualifications, you risk losing legal protection if issues arise during transportation. Always conduct thorough background checks before signing contracts.

A: Destination accuracy is paramount. The U.S. is vast, and some place names (e.g., Washington) may refer to multiple locations. Always verify the exact state name and ZIP code with customers to prevent shipping errors. Additionally, different clients may have different warehouses, so confirming the final destination helps avoid complications and extra costs.

A: Major clients often have specific demands. Exporters should focus on:

- Container loading requirements: Large retailers may require zone-based loading.

- On-time delivery: Strict deadlines must be met to avoid penalties. Track container status diligently.

- Accurate documentation: Prepare all documents at least seven days before vessel arrival to prevent demurrage charges.

A: These fees vary by port and are charged by destination terminals. Before shipment, confirm the specific policies. For major clients, offering extended free periods may enhance satisfaction and strengthen business relationships.

A: U.S. route freight typically operates on contract pricing, not available through all forwarders. The FMC ensures fair and transparent pricing, with all carriers required to comply. When negotiating with forwarders, inquire about contract pricing and associated terms.

A: U.S. routes enforce strict weight limits: 17.3 tons for small containers and 19.5 tons for large ones. If client requirements exceed these limits, consider:

- Misdeclaration: High-risk short-term solution.

- Base port distribution: Higher cost but compliant.

- Rail transfer: Some carriers permit rail transfers from base ports—confirm availability.

A: Customs clearance is often the most complex aspect of international trade. U.S. Customs receives AMS data from exporting countries after vessel departure. Subsequent steps include:

- Submitting all required documents for import declaration.

- Requesting cargo release to ensure smooth clearance.

- Providing release documentation to consignees or designated agents.

- Confirming recipient readiness, especially for door deliveries.

A: While H.S. codes are globally consistent, accurate product descriptions are vital for U.S. tariff determinations. For DDP transactions, precise product names and H.S. codes are mandatory—particularly for footwear, where samples must be submitted for verification. Regularly updating documentation helps minimize errors.

A: Two primary methods exist:

- Consignee-based clearance: The recipient provides a Power of Attorney (POA) and guarantee—suitable for most cases.

- Shipper-based clearance: Used when shippers and consignees are separate; requires shipper POA and bond purchase. Both methods require the U.S. consignee's tax ID.

A: The clearance process typically involves:

- Preparing documents upon receiving arrival notices.

- Submitting customs declarations (usually resolved within 48 hours).

- Ensuring consistency among bills of lading, invoices, packing lists, and consignee information.

- Comparing transfer and release procedures. For door deliveries, confirm recipient preparedness to expedite processes.

A: LCL shipments consolidate multiple shippers' goods to reduce costs. Key considerations include:

- Accurate packaging and billing: Ensure all LCL cargo complies with regulations to avoid fee disputes.

- Avoid carrier specifications: Multiple carrier options increase flexibility and reduce potential issues.

- Clear terms: Verify accuracy in shipping notifications and ensure client understanding.

In summary, exporting to the U.S. involves complex, stringent requirements. Exporters must meticulously analyze and plan each step to ensure smooth transactions and customs processes while protecting their interests. This Q&A guide aims to help exporters navigate international trade with greater confidence.