In modern freight transportation, railway locomotives serve as crucial transport vehicles, with their associated Harmonized System (HS) codes and export rebate policies drawing significant attention. Understanding these classifications can help businesses optimize their trade processes and capitalize on market opportunities.

This guide provides a detailed breakdown of HS codes and export rebate rates for various types of railway locomotives, from computer-controlled electric models to diesel-electric hybrids, along with relevant regulatory information.

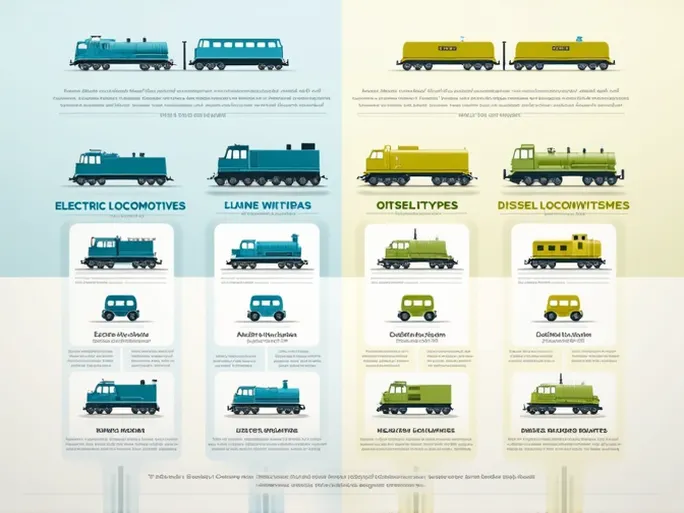

Railway Locomotive HS Codes Classification

1. Electric-Powered Railway Locomotives

-

Computer-controlled DC electric locomotives

:

HS Code: 8601101100

Unit: per unit/kg

Export rebate rate: 13% -

Other DC electric locomotives

:

HS Code: 8601101900

Unit: per unit/kg

Export rebate rate: 13% -

AC electric locomotives

:

HS Code: 8601102000

Unit: per unit/kg

Export rebate rate: 13% -

Other externally powered electric locomotives

:

HS Code: 8601109000

Unit: per unit/kg

Export rebate rate: 13% -

Battery-powered electric locomotives

:

HS Code: 8601200000

Unit: per unit/kg

Export rebate rate: 13%

2. Diesel-Electric Railway Locomotives

-

Computer-controlled diesel-electric locomotives

:

HS Code: 8602101000

Unit: per unit/kg

Export rebate rate: 13% -

Other diesel-electric locomotives

:

HS Code: 8602109000

Unit: per unit/kg

Export rebate rate: 13%

3. Other Types of Locomotives

-

Other railway locomotives and tenders

:

HS Code: 8602900000

Unit: per unit/kg

Export rebate rate: 13%

4. Auxiliary Vehicles

-

Electrically powered railcars for passengers or freight

:

HS Code: 8603100000

Unit: per unit/kg

Export rebate rate: 13% -

Other self-propelled railway passenger/freight cars

:

HS Code: 8603900000

Unit: per unit/kg

Export rebate rate: 13%

5. Inspection and Maintenance Vehicles

-

Tunnel clearance inspection vehicles

:

HS Code: 8604001100

Unit: per unit/kg

Export rebate rate: 13% -

Rail grinding trains

:

HS Code: 8604001200

Unit: per unit/kg

Export rebate rate: 13% -

Other railway inspection vehicles

:

HS Code: 8604001900

Unit: per unit/kg

Export rebate rate: 13% -

Overhead line equipment installation vehicles

:

HS Code: 8604009100

Unit: per unit/kg

Export rebate rate: 13% -

Other railway maintenance vehicles

:

HS Code: 8604009900

Unit: per unit/kg

Export rebate rate: 13%

6. Non-Powered Vehicles

-

Railway passenger coaches (non-powered)

:

HS Code: 8605001000

Unit: per unit/kg

Export rebate rate: 13% -

Tramway passenger/luggage cars (non-powered)

:

HS Code: 8605009000

Unit: per unit/kg

Export rebate rate: 13%

7. Tank Wagons and Others

-

Railway tank wagons (non-powered)

:

HS Code: 8606100000

Unit: per unit/kg

Export rebate rate: 13% -

Railway dump wagons (non-powered)

:

HS Code: 8606300000

Unit: per unit/kg

Export rebate rate: 13% -

Railway covered/closed wagons (non-powered)

:

HS Code: 8606910000

Unit: per unit/kg

Export rebate rate: 13%

Key Takeaways

This comprehensive classification of railway locomotives and their corresponding HS codes reveals that electric and diesel-electric locomotives maintain significant market positions. Businesses can leverage this information to enhance trade planning and operational efficiency, potentially increasing economic benefits. Staying informed about relevant policy developments enables companies to dynamically adjust their export strategies and maintain competitive advantages in the global marketplace.