ATA Carnet Simplifies Global Trade for Exhibits and Equipment

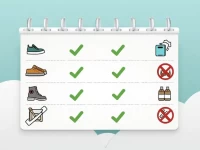

The ATA Carnet is used for customs clearance in international trade, suitable for various goods, including exhibition items, professional equipment, commercial samples, scientific instruments, and sports equipment. Goods using the ATA Carnet must meet specific conditions, particularly in China, where only items related to exhibitions are allowed. Understanding the relevant regulations helps ensure smooth customs procedures.