When exporting hazardous materials, clients frequently encounter several critical issues. Below is a summary of the main concerns:

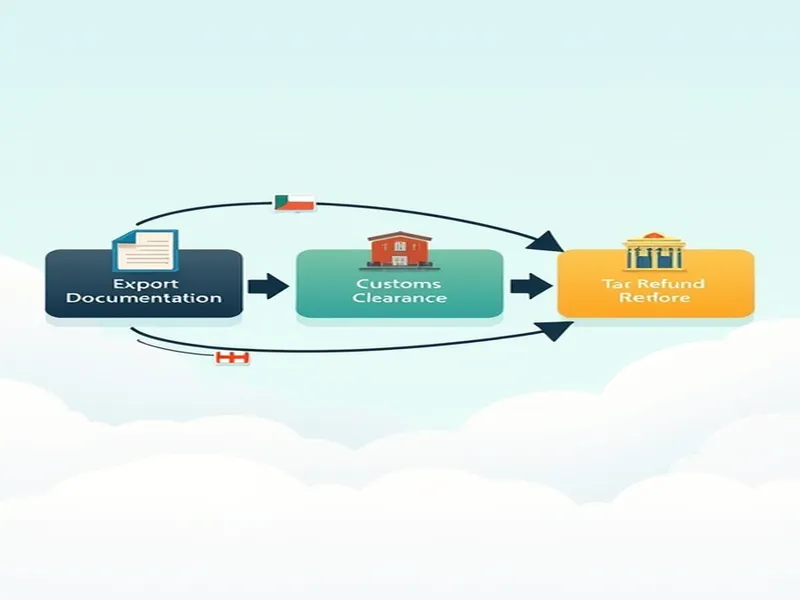

Customs Declaration and Tax Refund Procedures

- Standard customs declaration allows for smooth acquisition of export declaration documents and subsequent tax refunds.

- For third-party declaration arrangements (buying declaration services), tax refunds are not applicable. However, using another company's export qualifications may involve service fees.

Relationship Between Export and Import Customs Procedures

The export declaration process at the origin port has no direct connection with import customs clearance at the destination port. The critical factor for destination clearance lies in the required documentation, as different countries' customs systems operate independently without affecting the export process.

Required Documentation for Import Customs Clearance

- Customs declaration documents (including packing lists, invoices, etc.)

- Product specifications and documentation

- Certificate of origin

- Sales contract

The above summarizes common issues in hazardous goods export processes. For specific customs clearance requirements, we provide comprehensive assistance, including professional import clearance services where we possess specialized expertise.