Bonded warehouses serve as a crucial link in international trade, offering businesses the dual benefits of cost reduction and enhanced market competitiveness. As global trade continues to expand, an increasing number of companies are focusing on how to efficiently and compliantly handle customs clearance procedures for bonded goods. Particularly in today's complex global supply chain environment, understanding bonded warehouse operations and customs clearance processes has become essential. This article provides an in-depth exploration of bonded goods clearance procedures to help readers better grasp the key steps and considerations.

I. Overview of Bonded Warehouses

A bonded warehouse refers to a customs-approved facility for storing goods that have not yet cleared customs or had duties paid. These warehouses allow businesses to defer payment of tariffs and import VAT, enabling companies engaged in cross-border trade to effectively reduce inventory costs and improve logistics efficiency.

The primary functions of bonded warehouses include:

- Reducing capital costs: Businesses can store goods without immediate duty payment, allowing for better cash flow management.

- Enhancing market responsiveness: Companies can adjust inventory levels and modify procurement strategies more flexibly to quickly adapt to market changes.

- Boosting regional economic development: Often located in special economic zones, bonded warehouses attract foreign investment and increase regional trade activity.

II. Import Customs Clearance Process

When importing goods into a bonded warehouse, the owner or their agent must submit required documents to customs according to regulations. The key steps are as follows:

1. Preparing Customs Documentation

Prior to warehouse entry, the owner must submit three copies of the Import Customs Declaration , each stamped with "Bonded Goods" and specifying the destination warehouse. Additional required documents include:

- Bonded Warehouse Registration Certificate: Issued by customs after reviewing business licenses and operational approvals, this document confirms the company's eligibility to use bonded facilities.

- Inspection Certificates: For goods subject to mandatory inspection, these certificates ensure product quality and safety compliance. Without proper inspection documentation, goods may be detained.

2. Document Submission and Duty Assessment

After compiling all documents, the owner submits them for customs review. Officials conduct thorough verification to ensure compliance. Upon approval, customs calculates applicable duties and taxes while permitting goods entry.

3. Goods Retrieval and Warehousing

Following customs clearance, the owner can retrieve goods from the bonded warehouse. During this process:

- The owner verifies goods against the declaration

- Warehouse staff confirm quantity and condition

- Customs stamps the declaration to confirm warehouse receipt

III. Export Customs Clearance Process

For bonded goods being re-exported, owners must follow these procedures:

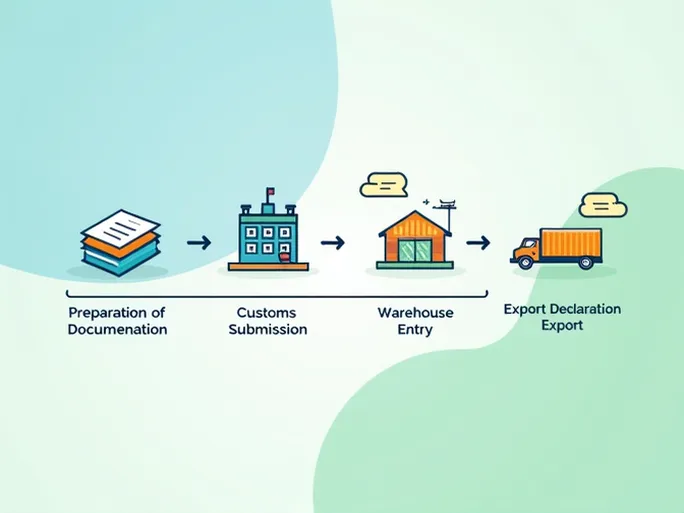

1. Preparing Export Documentation

Owners submit three copies of the Export Customs Declaration along with the original import declaration for reference.

2. Customs Review

Officials verify export compliance before releasing goods and notifying the warehouse.

3. Goods Retrieval and Transportation

After receiving customs clearance, owners arrange compliant transportation while warehouse staff confirm proper outbound documentation.

4. Completing Transfer Procedures

For goods transiting through other ports, owners must complete proper customs transfer formalities with all required documentation to prevent delays.

IV. Key Considerations

When handling bonded goods, pay special attention to:

- Transport compliance: Strictly follow customs regulations for bonded goods transportation to avoid penalties.

- Post-approval requirements: For goods approved for domestic sale, complete import procedures and pay duties promptly.

- Registration importance: Process required registrations for processing operations to ensure full compliance.

- Document accuracy: Ensure all submitted information is truthful and precise to avoid legal consequences.

In conclusion, bonded warehouses play a vital role in modern international trade. By streamlining customs processes, they accelerate goods movement, reduce holding costs, and strengthen global competitiveness. To maximize these benefits, businesses must thoroughly understand warehouse operations and clearance procedures, ensuring every step meets compliance standards. Only through proper processes and rigorous management can companies navigate today's complex global economy and achieve sustainable growth.