With the development of globalization and increasing market demand, marble import and export transactions have become more frequent. It is crucial that we clearly understand the relevant Harmonized System (HS) codes and applicable tariffs to better standardize our business operations.

Marble Classification Under HS Code 68.02

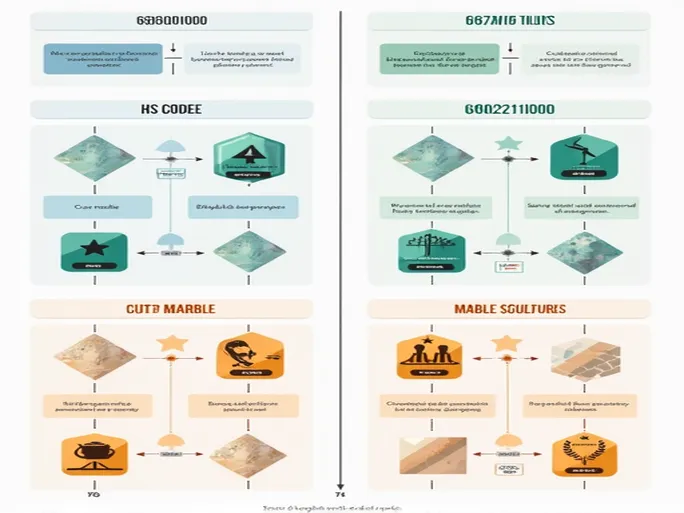

According to the latest customs import and export tariff regulations, marble falls under HS code 68.02 . This category covers various marble products, with specific codes determined by factors such as the marble's intended use, degree of processing, dimensions, color, veining, and specifications. Therefore, accurate classification during import/export declarations is a critical step.

Detailed Code Breakdown

Let's analyze these codes step by step:

6802.10.1000 applies to marble tiles, slabs, and blocks. Currently, this classification carries a Most-Favored-Nation import tariff rate of 24% . This rate directly impacts our cost control and pricing strategies, making it essential to monitor related policy changes to ensure both compliance and profitability.

The 6802.21.1000 classification covers marble that has been simply cut or sawn with only one flat surface. As this involves minimal processing, it enjoys a relatively lower tariff rate of 10% . Proper classification here can significantly affect both compliance costs and market competitiveness.

For marble carvings and sculptures ( 6802.91.1000 ), which require more sophisticated craftsmanship, the tariff rate returns to 24% . This underscores the importance of thoroughly understanding product details and processing levels when declaring marble products.

Finally, 6802.91.9000 applies to other processed marble products, with a tariff rate of 10% . This catch-all category requires particular attention during declaration to ensure all product descriptions meet customs requirements.

Key Considerations for Compliance

In practice, accurately describing marble characteristics is paramount. Effective compliance management not only facilitates smooth customs clearance but also helps build strong international trade credibility.

Heading 68.02 specifically includes worked monumental or building stone (excluding slate) and articles thereof. This serves as the fundamental basis for marble classification, ensuring we adhere to global trade regulations while supporting sustainable business growth.

In conclusion, understanding marble's customs classification and tariff policies is essential for our operations. I hope this discussion has provided clarity that will help navigate future trade activities with greater confidence.