In modern society, the selection of architectural and decorative materials reflects both aesthetic and practical needs. Among these materials, marble stands out as an elegant and versatile choice that has become a favorite among designers and architects. However, as international trade grows increasingly complex, many importers face challenges with customs classifications and tariffs when importing marble. In this context, understanding marble's HS codes and corresponding tariff rates becomes crucial—not only for smooth business operations but also for cost control and market competitiveness.

Marble Classification in International Trade

Marble is classified under heading 68.02 in China's Customs Import and Export Tariff and Declaration Guide. This category specifically covers worked monumental or building stone (excluding slate) and articles thereof. Different marble products are strictly distinguished by HS codes based on factors such as:

- Function and purpose

- Degree of processing

- Dimensions

- Color and veining patterns

Each detailed HS code embodies complex trade regulations and economic logic, making accurate understanding essential for effective communication between importers and customs authorities.

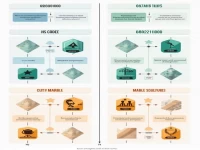

Key HS Codes and Tariff Rates for Marble

6802101000: This code applies to marble tiles, slabs, and similar products, subject to a 24% Most-Favored-Nation (MFN) import tariff rate. The relatively high rate reflects the importance of these building materials in the domestic market and highlights the cost considerations importers must factor into their procurement decisions.

6802211000: Covering marble that has been simply cut or sawn flat, this classification carries a lower 10% MFN tariff rate. The more favorable rate may make these products particularly attractive to importers looking to balance quality with cost efficiency.

6802911000: This code pertains to marble carvings and sculptures, also subject to a 24% tariff. These products often serve artistic and decorative architectural purposes, combining cultural value with economic worth. Importers should consider both the commodity price and the artistic value when positioning these items in the market.

6802919000: This catch-all classification covers other worked marble and articles not fitting the above categories, with a 10% tariff rate. The diversity of products in this category offers importers broader market applications and more flexible sourcing options.

Customs Declaration Considerations

When filing customs declarations, suppliers must provide detailed information about the marble products, including:

- Intended use

- Processing methods

- Dimensions

- Color and patterns

- Other specifications

This information helps customs officials accurately classify goods and ensures proper tariff assessment. By following this process, importers can better align with market demands and industry standards while achieving their commercial objectives.

Strategic Implications for Importers

Marble's HS codes and tariff rates significantly influence importers' strategic decisions. Through thorough understanding of these regulations, importers can:

- Better meet market demands

- Navigate complex trade environments

- Develop competitive advantages

Only with detailed knowledge and prudent strategies can marble truly showcase its unlimited potential in architecture and decoration. For importers exploring this field, understanding market dynamics and seizing opportunities remains paramount—with compliance to customs regulations serving as the key to unlocking market potential.